The financial landscape in India has experienced remarkable changes in recent times. The rise in the flow of investments into the private sector from the moderately organized players and increasing private capital has led to a situation where diverse forms of financial instruments and organizational structures have come into existence. In this dynamic expansion of financial instruments and new organizational structures, investors are looking for various new methods to enhance returns while balancing risk and regulatory requirements. The various new forms of entity structures that have developed as a result of this, such as investment holding companies and special purpose vehicles that are designed to manage such investment assets, may inadvertently find themselves falling under the financial regulations categorized for Non-Banking Financial Companies (NBFCs).

While new forms of instruments and entity structures offer flexibility and tailored solutions for investment and capital flow, these entities by holding investment assets and carrying out financial activities operate in a way similar to the traditional NBFCs. Therefore, the Reserve Bank of India (RBI) has imposed some stringent requirements on such deemed NBFCs to safeguard financial stability and ensure proper oversight. Understanding the concept of deemed NBFC and the key triggers for NBFC applicability is therefore crucial for all the businesses involved directly or indirectly in such structures, and they must remain vigilant and should carry out thorough compliance checks to avoid unexpected regulatory consequences.

Difference between NBFC and Deemed NBFC.

A “NBFC” is a company registered under Indian Companies Act that engages in activities such as providing loans and advances, acquiring shares, stocks, bonds, debentures, or securities issued by the government or local authorities, as well as leasing, hire-purchase, insurance, and chit business. However, it does not include institutions whose main business involves agricultural activities, industrial operations, buying or selling goods (excluding securities), providing services, or dealing with the sale, purchase, or construction of immovable property. Additionally, a non-banking institution that primarily receives deposits through any scheme or arrangement—whether in lump sums, installments, or other methods—qualifies as an NBFC, specifically classified as a Residuary Non-Banking Company.[1]

Now the RBI’s principal business criteria, also known as the 50-50 rule, specifies that if 50% or more of a company’s assets are derived from financial activities, then such a company is deemed to be an NBFC. Therefore, such companies are subject to the NBFC regulations of the RBI even if their primary business does not happen to be financial services.

The RBI, in its press release dated 8.4.1999, had categorically stated that

“………in order to identify a particular company as a non-banking financial company (NBFC), it will consider both, the assets and the income pattern as evidenced from the last audited balance sheet of the company to decide its principal business. The company will be treated as an NBFC if its financial assets are more than 50 percent of its total assets (netted off by intangible assets), and income from financial assets should be more than 50 percent of the gross income. Both these tests are required to be satisfied as the determinant factor for principal business of a company.”[2]

Now entities such as Limited Liability Partnerships (LLPs), Partnership firms, and Associations of Persons (AOPs) are often considered flexible business structures suitable for varieties of businesses. However, it is crucial for such entities, which control significant financial assets or carry out major financial activities, to carefully assess business strategies as venturing into the financial activities might bring unexpected regulatory consequences, such as adherence to various stringent norms specified by the RBI.

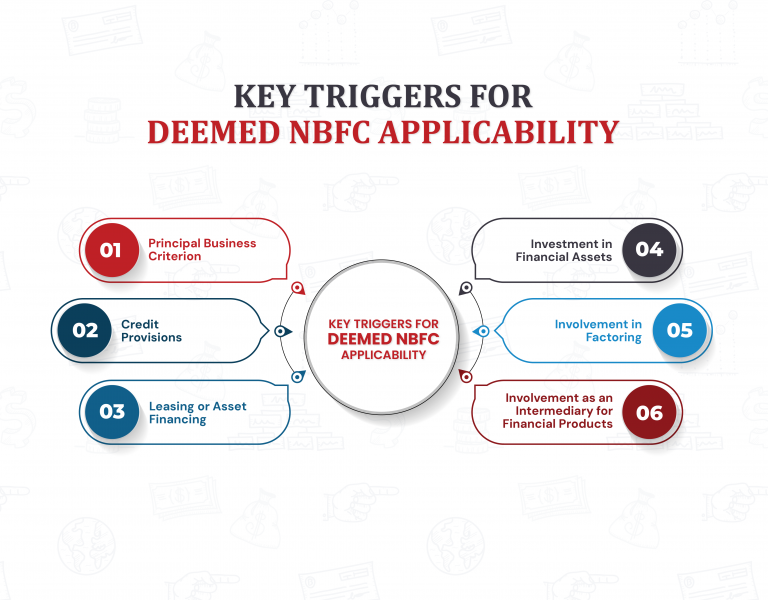

Key Triggers for Deemed NBFC Applicability

The determination of whether a company is deemed an NBFC depends on various key triggers. Therefore, it is very much imperative for investment holding entities to evaluate these triggers to help them navigate the regulatory landscape in an effective manner. Let us try to understand these triggers in a detailed manner.

Principal Business Criterion

As stated above, the 50-50 rule is one of the key triggers for NBFC applicability. The rule takes two parameters into consideration while determining the applicability, viz., financial assets and income from financial assets. If any of these two parameters exceed 50% of its assets or 50% of its income, respectively, the company would be considered to have financial business as its core operation and would therefore be classified as an NBFC.

Credit Provisions

Any company providing loans or credits or engaged in any sort of lending activity could be considered a deemed NBFC if it falls under its primary business criterion. Even if the company got engaged in providing loans in order to boost its own core business, such as offering credits to its existing or prospective customers, the magnitude of such loans or credits might lead to the business being classified as NBFC.

Leasing or Asset Financing

Companies that are involved in asset financing or other purchases of assets, which are then provided to their customers on a lease or hire-purchase basis, often find themselves deemed to be NBFCs if these activities surpass the 50% threshold of their assets or income, which would make such entities liable to the stringent regulatory regime of the RBI.

Investment in Financial Assets

Several companies whose core business is altogether different but have been engaged in financial investments such as holdings in stock, mutual funds, or other such financial instruments too might find themselves deemed to be NBFCs if such companies are earning a substantial portion of their income from such financial trade activities.

Involvement in Factoring

Companies that are engaged in factoring and are selling their bill receivables to a third party at a discounted rate to increase their cash flow may also find themselves subject to the regulatory provisions of the RBI for deemed NBFCs if the revenue generated from such activities surpasses the principal business criterion.

Involvement as an Intermediary for Financial Products

Companies that act as intermediaries facilitating financial investments or managing the financial portfolios of their clientele may also find themselves deemed NBFCs if the income derived from such services contributes a significant portion of their total earnings.

Regulatory Implications for Deemed NBFC

Once an entity falls under the category of NBFC, it also comes under the stringent regulatory framework governed by the RBI. Let us try to understand some of these regulatory mandates herein.

Licensing

NBFCs are required to obtain licenses under the rules of the RBI to function legally. The process of obtaining the license involves various criteria, such as adherence to various regulations and maintaining minimum net-owned funds. Failure to obtain proper licensing can result in various unwarranted consequences and restrictions on their business activities.

Mandatory Filings to RBI

NBFCs are mandated to submit regular reports on their asset composition, capital adequacy, and non-performing assets (NPAs).

Capital Adequacy Requirements

As per the regulations specified by RBI, the NBFCs are required to maintain a minimum capital adequacy to mitigate potential financial losses. They are mandated to maintain a certain percentage of their total risk-weighted assets as capital.

Risk Management Mechanism

The NBFCs are required to maintain a risk management mechanism to monitor and control credit, market, and operational risks. They should have a Chief Risk Officer to manage the whole risk management system of the organization. These entities are also needed to maintain a risk appetite policy and to develop a framework to assess its ability to withstand potential financial hazards.

Restrictions on Certain Activities

The NBFCs need to be strictly vigilant about the various restrictions imposed by the RBI on them. These restrictions include the limitations on investment in real estate or unlisted securities and caps on exposure to certain sectors. A leniency in complying with such restrictions might result in severe consequences under the regulations specified.

Reporting by Auditors

Auditors too play a crucial role in ensuring regulatory compliance through their reports. The auditor is required to furnish their audit report as per the provisions of section 143 of the Companies Act, 2013, read with Rule 11 of the Companies (Audit and Auditors) Rules, 2014. In cases where a company falls within the ambit of the definition of Deemed NBFC and they have not complied with the RBI regulations, the auditor would need to evaluate whether reporting such a non-compliance is warranted in the audit report. While there is no explicit requirement for the same, considering the seriousness of the non-compliance and the financial and legal implications involved, the auditor would have to make a judgment on the same.

For those companies to whom the Companies (Auditor’s) Report Order, 2020 applies, there is a specific question on whether the company is a Deemed NBFC and whether they have carried out the necessary compliances. Therefore, the auditor would be required to report under this clause.

In addition to the audit report as mentioned above, auditors are required to make separate reports to the Board of Directors to ensure whether the company has met the statutory regulations with regard to the norms outlined for NBFCs, and any non-compliance or potential risks in this regard must be reported unfailingly. A thorough and comprehensive audit process with reports containing details of its Certificate of Registration (CoR), details of its credit and public deposits, if any, and all the other aspects specified by RBI is to be reported by the auditor.

Conclusion

The main intent of the regulatory policies of the Reserve Bank of India related to deemed NBFCs is to manage and regulate the financial activities of various entities even if such activities do not come under their core areas of operation. Companies that are not on the same page as the RBI with respect to such regulations are at the potential risk of facing the consequences under the regulatory regime.

Monitoring the financial metrics of the business organization carefully and maintaining clear and thorough documentation of all transactions and financial activities is crucial in this regard. Businesses should be in regular consultation with their advisors, who can provide them with the necessary insights into the regulatory framework, helping them navigate this complex regulatory landscape efficiently. By understanding and properly evaluating the key triggers for NBFC applicability, businesses can avoid being subject to unintended compliance issues while exploring options to engage in newer ways of investments.