Table of Contents

Introduction

Ethical challenges in auditing rarely arise from a lack of standards or frameworks; they emerge in moments of pressure like tight timelines, demanding clients, long-standing professional relationships, fee dependencies, and subtle expectations to manage outcomes. While the auditing profession is supported by a strong ethical architecture, which we have dealt with in detail in our previous blog to provide the clarity on ‘what’ is expected of auditors in terms of ethical practices, the real challenge lies in “how” those expectations are lived out on the field.

Hence, building on to our previous blog, this blog shifts the lens to practice, examining real-life disciplinary cases to highlight how ethical breaches can occur and what audit professionals can do differently to uphold ethics in a demanding, real-world audit landscape.

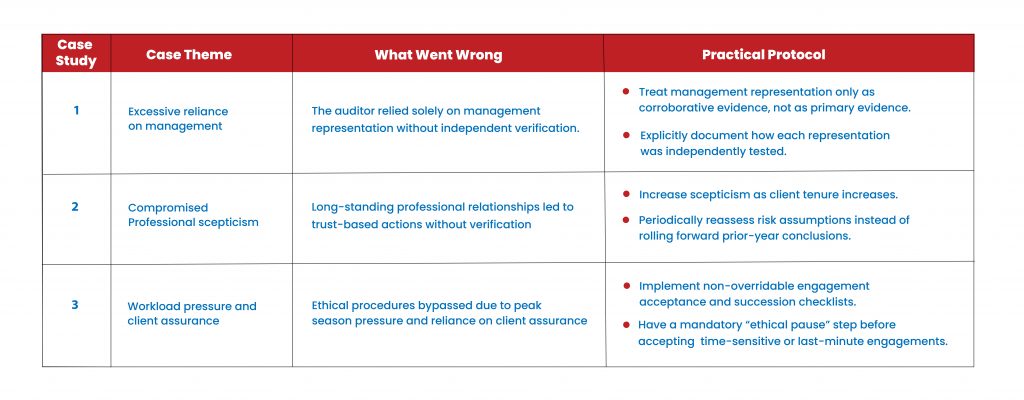

I. Case Study 1: Excessive Reliance on Management Representation

A. What Actually Happened

In a disciplinary case examined by the ICAI1, the auditor concluded in the CARO 2016 report that cost records were not applicable to the entity, solely based on management’s written representation. The auditor did not independently verify the applicability under the Companies (Cost Records and Audit) Rules, 2014.

Standards on Auditing (SA) 580 “Written Representations” clearly states that management representation letters cannot substitute appropriate audit evidence.

The lapse resulted in incorrect reporting, violation of SA 200 “Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Standards in Auditing” and SA 250 “Consideration of Laws and Regulations in an Audit of Financial Statements”, and ultimately a reprimand (which is an official censure recorded against the member for professional misconduct) with a penalty of ₹1,00,000.

B. Key Takeaways from the Case

- Management representations are supporting evidence, not substitute audit evidence.

- Auditors must independently verify regulatory applicability (here, cost records) even when management confirms non-applicability in writing.

- Familiarity with the client or long association does not dilute statutory responsibility.

- Professional scepticism and due diligence remain mandatory regardless of management assurances or absence of immediate stakeholder loss.

- Errors driven by oversight or reliance on management representation are still treated as professional misconduct and gross negligence, reinforcing that “no loss caused” is not a defence in audit ethics.

II. Case Study 2: Professional Scepticism Replaced by Long-Standing Relationship

A. What Actually Happened

This is a disciplinary case2 out of the core audit work, yet highly relevant for all the areas where the audit professional is involved along with audit. A Chartered Accountant witnessed and attested signatures on a partnership retirement deed that was later used to register changes with the Registrar of Firms. One of the signatures attested by the CA was a partner who had passed away in 1994.

The CA later admitted that the signatures were not executed in his presence and he relied on assurances from the managing partner due to a long-standing professional relationship spanning over two decades.

The Disciplinary Committee held that attesting signatures without verifying the identity and physical presence of the signatories amounted to a serious lapse, bringing disrepute to the profession. The CA was reprimanded for professional misconduct under Clause (2) of Part IV of the First Schedule to the Chartered Accountants Act, 1949.

B. Key Takeaways from the Case

- Long-standing client relationships can create familiarity threats that silently erode professional scepticism and judgement. Hence, the length of association increases, rather than reduces, the duty to question, verify, and document critical facts.

- Trust based on past relationships cannot replace basic verification procedures, even for non-audit attestations.

- Failure to verify identity and execution of documents undermines professional integrity and public trust.

- Ethical responsibility applies beyond audits. Any act done “as a Chartered Accountant” attracts professional standards and accountability.

III. Case Study 3: Ethical Lapses Driven by Workload and Client Assurance

A. What Went Wrong

This disciplinary case3 highlights ethical failures driven by time pressure, client reliance, and professional convenience. In this case, the CA accepted and completed the tax audit of an entity without first communicating with the previous auditor and despite knowing that undisputed audit fees of the previous auditor were outstanding. The CA admitted that the lapse occurred due to workload pressure and tight timelines during the peak tax audit season and that he relied on the client’s assurance that there was no dispute with the earlier auditor.

The Disciplinary Committee held that failure to communicate with the previous auditor and acceptance of audit despite unpaid fees violated the Code of Ethics and Council General Guidelines, amounting to professional misconduct. The CA was reprimanded and penalised.

B. Key Takeaways from the Case

- Tight timelines and workload pressure are not valid justifications for bypassing ethical safeguards or mandatory professional procedures. Workload pressures are real, but ethics outweigh them always.

- Client assurances cannot replace independent verification, and such acts would impair auditor independence.

- Procedural shortcuts taken under pressure are treated as ethical violations, reinforcing that convenience-driven decisions can attract disciplinary consequences without any leniency.

IV. Case-Driven Lessons and Ethical Safeguards

Conclusion:

Ethics becomes meaningful only when implemented consistently, not occasionally. These real cases discussed above clearly indicate that ethical lapses often begin with small oversights such as skipped verifications, unquestioned familiarity, inadequate documentation, or client-driven shortcuts. Therefore, a structured system with adequate scepticism on the auditors’ part can prevent such lapses from happening.

For businesses, an ethical audit builds investor trust, strengthens governance, and creates resilience whereas for audit professionals, it works as a safeguard of their credibility which is the most valuable asset they have got. When ethics guide not only your decisions but also your daily habits, the entire audit ecosystem becomes stronger, dependable, and truly aligned with the public interest which this noble profession is meant to serve.

Reference

1 Disciplinary Case No: PR/G/192/2019-DD/217/2019/DC/1356/2020 order dated 9th May 2024

2 Disciplinary Case No: PR- 368/2014/DD/11/15/DC/653/2017 order dated 7th Sep 2020

3 Disciplinary Case No: PR/614/22/DD/504/2022/DC/1843/2023 order dated 20th Jan 2025

Contributors

CA N Srilatha Bhat – LinkedIn

Kuldeep Sarma – LinkedIn

Poonam Vernekar – LinkedIn